- Home

- Global Payroll

- Earned Wage Access: The Need Of The Hour!

Earned Wage Access: The Need Of The Hour!

Published :

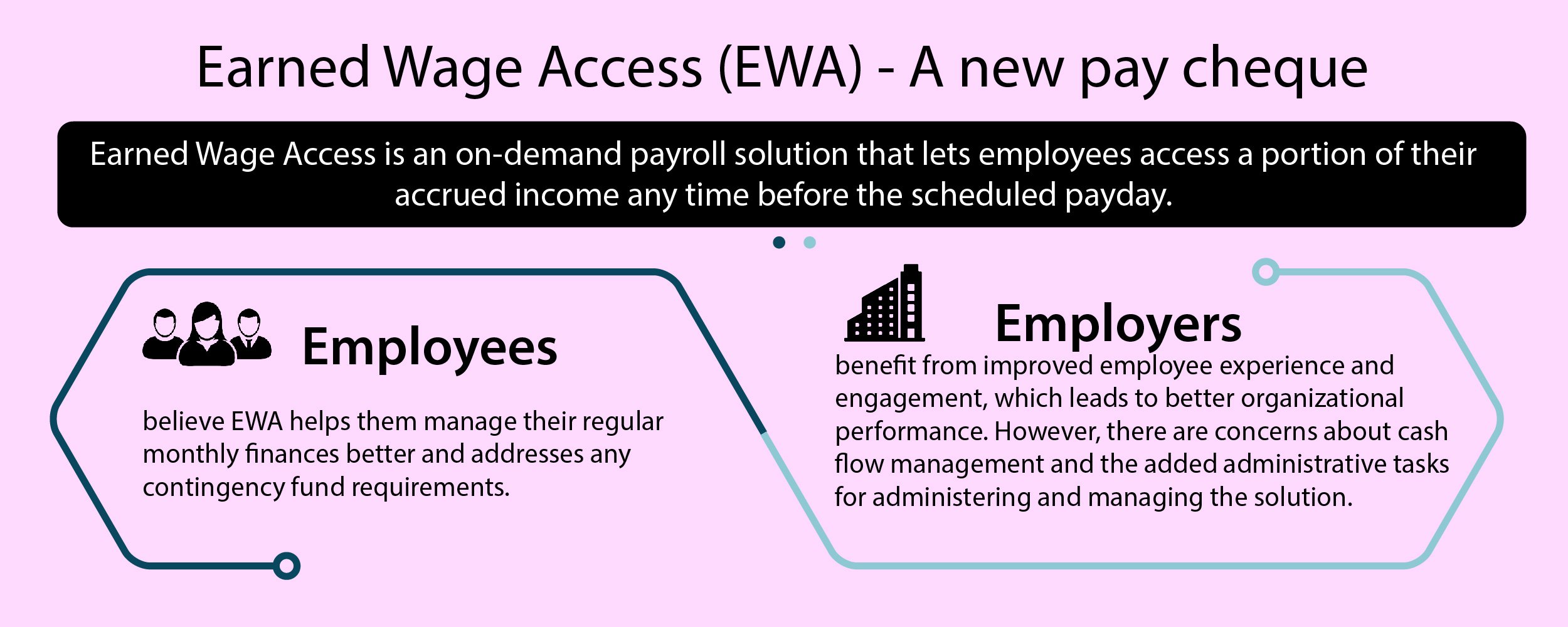

In today's fast-paced and unpredictable world, financial stability and flexibility have become more crucial than ever. Many individuals find themselves facing unexpected expenses or financial gaps between paychecks, leading to financial stress and hardship. However, a transformative solution known as Earned Wage Access (EWA) has emerged to address this pressing need. EWA allows employees to access a portion of their earned wages before the traditional payday, providing them with greater control over their finances and bridging the gap between financial obligations and income. It has quickly gained recognition as a game-changing financial tool, revolutionizing the way employees manage their cash flow.

Even though payday loans have been around for longer, they are for a different purpose and are plagued with predatory pricing with very high-interest rates. The annual percentage rate for payday loans can range from 36 percent to 730 percent, depending on the tenure of the loan.

With the need for financial flexibility at an all-time high, EWA has become the need of the hour, empowering employees and transforming the way wages are accessed and utilized.

Earned Wage Access (EWA) enables employees to access a portion of their accrued income anytime ahead of the fixed payday. It offers employees easy liquidity, which helps them to meet contingency expenses arising before a payday without resorting to high-interest loans.

The cost of living has been increasing across the globe, with record inflation rates reducing consumer purchasing power. The inflation rate in the United Kingdom touched a 41-year high of 11.1% in October 2022, with people unable to afford a basic minimum standard of living. A similar situation exists across many countries, and the worst affected are the low-to-middle-income employees and people working on contracts.

According to EY-Refyne research covering 3,010 salaried Indians, 60 percent of the respondents earning more than INR 1 lakh a month find the amount inadequate to cover all expenses. Almost 80 percent of employees exhaust their salary before the month ends. The monthly shortfall, coupled with any unplanned expenses, leads people to resort to alternative finance options.

In an uncertain world, EWA is an important tool that enables organizations to ease their employee's financial stress.

EWA has emerged as a cost-effective alternative liquidity option for employees, which allows them to build financial resiliency and avoid getting trapped in the vicious cycle of high-interest loans from informal and unregulated credit providers.

Employees are spared the mental stress and agony that they have to endure until the next payday. EWA enables organizations to improve employee wellness by addressing their financial concerns. This enhances employee experience, which has a direct impact on an organization's revenue and profitability.

Besides helping employees, EWA also enables the human resources (HR) department to save hours spent processing salary advances without EWA or on-demand pay payroll solutions.

There are primarily two business models for EWA solutions:

Business-to-Business (B2B) - It is an employer-enabled model in which they enroll their organization with the EWA solution provider. The provider integrates the EWA solution with employers' payroll and offers the solution either as an employee benefit or a low-cost option in which employees pay a small transaction fee. The employer may pay a per-month per-employee fee or a per-transaction fee, depending on the vendor pricing model. The employee receives the remaining salary on payday after deducting the amount withdrawn as early wage.

The model can be further categorized into two categories.

Employer-funded - The solution is offered as an employee benefit, and the EWA service is completely funded by the employer. The employer integrates the EWA solution with payroll, Human Capital Management (HCM), and time and attendance system to facilitate the processing and disbursal of early wages to the employee.

EWA vendor funded - The early wage payment to employees is funded by the EWA provider or the vendor. It requires a reconciliation process at the end of the pay cycle so that the salary paid to employees factors in the amount paid as early wage. Besides, the technology solution vendor needs to secure funding partners to facilitate early payment to employees. The EWA vendor-funded model is region or country-based since it requires vendors to comply with regional regulatory requirements.

Business-to-Consumer (B2C) - The model is similar to a payday loan or cash advance, with the employee submitting proof of income to the EWA provider through their application. However, the employee needs to bear interest or overdraft charges. The model does not offer significant advantages to employees and hence has not gained prominence.

Integrating Earned Wage Access into Payroll Software for Seamless Global Payroll Management

To ensure the scalability and long-term success of Earned Wage Access (EWA) programs, organizations must integrate EWA solutions directly into their core payroll software. Doing so not only improves user experience but also streamlines payroll processing while maintaining compliance across geographies. With businesses increasingly operating across borders, integrating EWA into global payroll systems is fast becoming a strategic necessity.

Seamless Integration with Payroll Software

For EWA to function efficiently, real-time synchronization between time tracking, attendance systems, and payroll software is critical. A robust EWA solution must integrate with existing payroll services infrastructure to automatically calculate accrued wages, determine eligibility, and execute early wage disbursals. This reduces manual intervention, minimizes errors, and enhances accuracy in payroll execution.

Enabling Global Payroll Compatibility

Multinational organizations with a distributed workforce need EWA systems that are adaptable to global payroll regulations. Each region has distinct statutory requirements, tax rules, and labor laws, making compliance a key challenge. Integrating EWA with unified payroll software ensures adherence to local regulations while offering a consistent employee experience across all geographies. Vendors offering multi-country payroll services with embedded EWA capabilities can help enterprises deliver a scalable, legally compliant solution globally.

Driving Efficiency in HR Operations

By embedding EWA into payroll systems, HR departments can significantly reduce the administrative burden associated with processing salary advances. It automates disbursement workflows, ensures accurate reconciliation at month-end, and reduces dependency on manual interventions, allowing HR professionals to focus on strategic workforce planning.

Ultimately, aligning EWA solutions with integrated payroll software and global payroll infrastructure allows organizations to deliver timely financial relief to employees while upholding accuracy, compliance, and operational efficiency across their payroll services.

In conclusion, Earned Wage Access has become a crucial tool for organizations and employees alike, offering financial flexibility and improved well-being. By embracing EWA solutions, organizations can enhance the employee experience, reduce financial stress, and foster a more resilient and motivated workforce. As the need for financial flexibility continues to rise, EWA remains the need of the hour, transforming the way wages are accessed and utilized, and paving the way for a more financially secure future for employees.

Enterprise asset management (EAM) involves the management of mission critical assets of an organization throughout each asset's lifecycle. EAM is used to plan, optimize, execute, and track the needed maintenance activities with the associated priorities, skills, materials, tools, and information. The aim is to optimize the quality and utilization of assets throughout their lifecycle, increase productive uptime and reduce operational costs.

Enterprise asset management (EAM) involves the management of the maintenance of physical assets of an organization throughout each asset's lifecycle. EAM is used to plan, optimize, execute, and track the needed maintenance activities with the associated priorities, skills, materials, tools, and information.

The software helps in effective maintenance of assets through preventive, predictive, shutdown and breakdown maintenance strategies. The system also helps enterprises mitigate equipment risks by enhanced safety standards. The streamlined operations and improved asset performance helps organizations increase their investment effectiveness.

EAM is important because it helps organizations track, assess, manage and optimize asset quality and reliability. Asset intensive Organizations have hundreds, thousands, even millions of assets which needs to be maintained to maximize / optimize life of these assets to increase the return on investment.

The key features of effective EAM are:

Asset Intensive companies under the following Industries :

Contact us for a meeting and schedule a demo

This differs on case to case basis, based on the type of installation and unique industry specific requirements. Contact us for a meeting and schedule a demo.

This differs on case to case basis, based on the type of installation and unique industry specific requirements. Contact us for a meeting and schedule a demo.

Stay Connected, follow us on LinkedIn / Twitter to know more about EAM Software latest trends.

All Rights Reserved. © Copyright 2024. Ramco Systems.