- Home

- Global Payroll

- Beyond Data Migration: Scalable Cloud Payroll Software Solutions

Beyond Data Migration: Scalable Cloud Payroll Software Solutions

Beyond Data Migration: Scalable Cloud Payroll Software Solutions

9:43

Published :

Transformation stories often spotlight customer experience, changed market dynamics, business re-modelling and notably AI in recent times. But the most underestimated disruptor sits quietly in the background: payroll. It’s the one system that touches every employee, at the minimum every month, without fail. A late salary erodes trust faster with uncomfortable questions at various layers thereby impacting productivity and morale than any broken promise. A compliance error can cost millions in fines, and a lack of visibility can cripple strategic decision-making. A seamless payroll can’t be dependent on chances but must be upright on a continuous basis, it has to have values much beyond the tag of operational necessity.

Enter Cloud payroll software: a modern approach that redefines and fortifies accuracy, compliance, visibility, traceability, and scalability. With cloud-based payroll software, enterprises move beyond fragmented legacy systems to platforms built for agility and coopetition. Getting these numerous pivotal benefits can’t come by simply moving data from an on-premise system to the cloud based system. Treating payroll modernization as a “lift-and-shift” project risks replicating old inefficiencies in a new environment.

While cloud payroll adoption often begins with data migration, stopping there misses the opportunity to unlock its full value. Simply moving data from an on-premise system to the cloud may deliver short-term efficiency gains, but it doesn’t address the structural limitations of legacy processes. Without rethinking how payroll connects with finance, HR, and compliance ecosystems, enterprises risk recreating the same silos.

The business benefits focused modernization requires a shift in mindset - from a transactional migration exercise to a holistic redesign of payroll architecture. That means building scalable payroll powered by cloud payroll software that can flex with changing workforce models, leveraging API-driven integrations to ensure real-time data flow across business functions, and adopting a modular payroll infrastructure that can evolve as regulations, geographies, and technologies change.

In essence, going beyond payroll migration is about transforming the function from a recurring operational necessity into a strategic enabler of agility, accuracy, transparency and growth, a future-ready backbone that supports the entire enterprise.

When organizations embrace cloud based payroll software, they unlock far-reaching benefits such as:

Also read: 6 Key Steps for a Seamless Legacy Payroll Migration

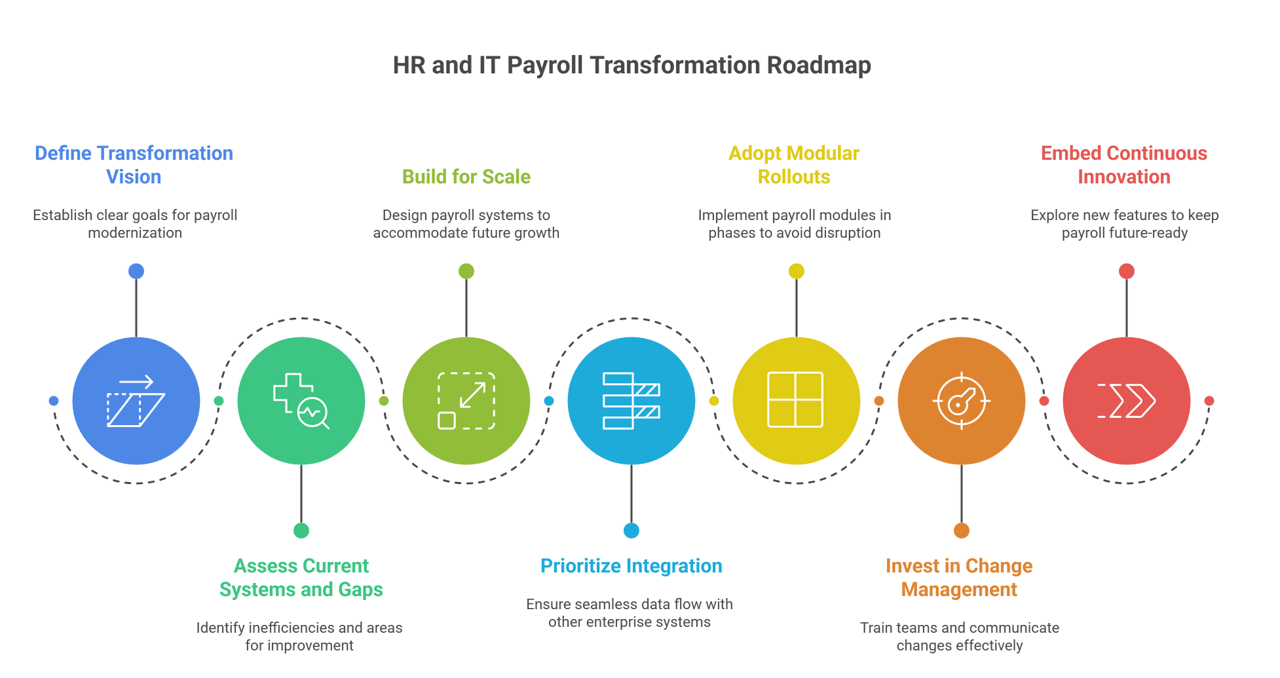

Maximizing the value of cloud based payroll software requires a structured approach. Here’s a roadmap for HR and IT leaders to guide this transformation journey:

Step 1: Define the Transformation Vision

Start by identifying why payroll needs to change. Instead of treating cloud payroll as a compliance tool, frame it as a transformation project. Map business goals such as scalability, efficiency, employee experience associated with transparency and intuitiveness and then align them with payroll modernization.

Step 2: Assess Current Systems and Gaps

Conduct a full audit of legacy systems, compliance workflows, areas of leakages or errors, and employee pain points. Identify where inefficiencies exist and how cloud based payroll software can address them with modular payroll infrastructure and automation.

Step 3: Build for Scale, Not Just Today

Don’t just migrate current processes; design with growth and/or diversification in mind. Implement scalable payroll systems that can handle expansion into new regions, new employee categories, changing market trends for usability and shifting compliance requirements.

Step 4: Prioritize Integration Early

Plan for API payroll integration upfront. Ensure payroll data connects seamlessly with HRMS, ERP, finance and business analytics platforms. This ensures payroll becomes part of a connected enterprise, not a standalone silo.

Step 5: Adopt Modular Rollouts

A big-bang approach can overwhelm teams. Instead, implement a modular payroll infrastructure in phases, starting with core compliance, then scaling to automation, analytics, and employee self-service.

Step 6: Invest in Change Management

Technology alone isn’t enough, the vision of payroll system catering beyond operational necessity must be seeped into peoples’ minds. HR and IT leaders must train teams, communicate changes clearly, and ensure payroll teams embrace a mindset that goes beyond payroll migration. The key to success is when the workforce is given to understand “what is into it for them”!

Step 7: Embed Continuous Innovation

The journey doesn’t end with deployment. Continuously explore features in cloud based payroll software such as predictive analytics, AI-powered compliance, and global workforce management tools. This ensures payroll remains future-ready.

The momentum behind cloud-based payroll solutions continues to grow as organizations recognize the strategic value of modernizing their payroll systems. Businesses are increasingly viewing payroll not just as an administrative function, but as a critical component that drives agility, compliance, and an enhanced employee experience.

At Ramco, we’ve been at the forefront of this transformation. With Payce Payroll Software, we deliver scalable payroll systems, API payroll integration, and a modular payroll infrastructure that helps businesses go far beyond payroll migration. From automation and compliance to analytics and employee self-service, Ramco ensures payroll becomes a strategic enabler of growth.

Turn payroll into a growth engine. Learn how Ramco Payroll Software helps enterprises build scalable, compliant, and future-ready payroll systems.

Payroll budgeting is the process of forecasting and managing a company’s employee costs to align with business goals. It’s critical for CFOs as it helps ensure financial stability, optimize workforce allocation, and avoid overspending. With rising employee costs and complex compliance regulations, effective payroll budgeting directly impacts profitability and growth.

Payroll software improves workforce cost management by offering real-time insights into employee expenses, including overtime, benefits, and bonuses. It automates payroll processing, reducing manual errors, and provides data-driven forecasts that help CFOs optimize budgets. This enhances decision-making, ensuring employee costs are aligned with overall financial goals and company performance.

Traditional payroll services often lack integration with HR and finance systems, creating inefficiencies and data discrepancies. They are also reactive, only processing payroll after the fact rather than helping forecast costs. These systems can lead to errors, compliance risks, and a lack of strategic insights, making it hard to align payroll with business goals.

Payroll solutions support salary benchmarking by providing real-time access to industry compensation data, ensuring that businesses offer competitive salaries. They also allow for streamlined management of variable compensation like bonuses, commissions, and performance-linked incentives. By analyzing payroll data, CFOs can align compensation with performance and market trends, retaining top talent and maintaining fiscal discipline.

When selecting payroll software, CFOs should prioritize scalability, ease of integration with existing HR and finance systems, and automatic compliance updates. The software should offer real-time payroll insights, support for global and local regulations, and robust security features to protect sensitive data. Predictive analytics and automation features are also crucial for strategic payroll management.

Payroll services ensure compliance by continuously updating to reflect changes in tax laws,employee regulations, and industry standards. They automate tax calculations, ensuring accurate deductions, filings, and reporting. With integrated compliance tools, payroll services also generate reports that help businesses stay audit-ready, minimizing penalties and reducing the risk of human error.

Archana Mehta brings nearly three decades of experience in IT product and services, specializing in delivery and program management, fostering customer centricity, and driving transformations. She currently serves as the Head of Customer Centricity at Ramco Systems for HR and Payroll systems, after leading impactful implementations across multi-geographic regions. Prior to Ramco, Archana's experience includes heading an offshore delivery center, IT consultancy, large program management, and account mining. She has also served as faculty at management institutes. Archana believes in an active lifestyle and is passionate about yoga, marathons, and excursions.

All Rights Reserved. © Copyright 2024. Ramco Systems.